DataRobot , the founder of an automated machine learning platform, announced it has appointed H.P. Bunaes as the Director of Banking to help the company leadership in the application of AI in Banks. H.P. Bunaes is a former executive of SunTrust Banks. He has a rich experience in leading the design and development of the risk data and analytics infrastructure used in credit decisions, pricing, portfolio management, and reserve and capital adequacy.

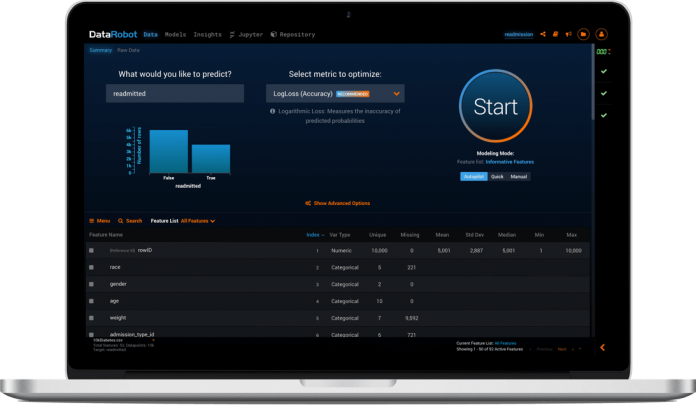

DataRobot offers an enterprise machine learning platform that enables users of all skill levels to develop and apply machine learning open source algorithms and AI faster to their operations and automate many complex processes. The platform trains and evaluates models and delivers AI applications at scale.

At DataRobor Bunaes will be responsible for helping banks leverage AI and machine learning to increase speed to market, improve model accuracy, and reduce the cost to develop, deploy, and maintain AI and analytics initiatives.

Jeremy Achin, the CEO of DataRobot shares, “H.P. is a seasoned executive whose experience will support DataRobot’s commitment to helping banks be more AI-driven so they can grow revenue, reduce costs, and manage risk.” He also adds, “H.P. is a tremendous addition to the team and he will help further establish DataRobot as the trusted advisor banks need to solve their machine learning and AI challenges.”

Bunaes has more than 35 years of experience in banking, with broad banking domain knowledge and deep expertise in data and analytics. He has held a variety of leadership positions in companies like SunTrust and FleetBoston.

While at SunTrust, Bunaes was appointed senior vice president and consumer bank data officer. As such, he led an enterprise-wide anti-money laundering initiative, including the implementation of real-time risk assessment engine and due diligence framework for new client on-boarding.

“I know firsthand the challenges banks face generating insights from data—processes can be manually intensive, predictions imprecise, and managing the data and modeling infrastructure difficult and expensive. DataRobot’s machine learning platform addresses all of these and allows banks to automate modeling and quickly and efficiently extract insights and deploy capabilities that deliver bottom-line benefits,” said Bunaes. “This is why joining DataRobot was a no-brainer, and I’m excited to help banks use machine learning to make their investments in data science pay off.”

H.P. will be a speaker at the Automation and Operational Efficiency in KYC Forum, which will take place June 25-26 in New Your City. He will share best practices for banks using AI and machine learning to mitigate risk and ensure regulatory compliance during the conference session “Using AI and Machine Learning in AML.”